5 themes for the year ahead

未来一年值得关注的五大主题The labor market is likely to be firmer.

The labor market has been in focus in the second half of 2024. The Sahm rule (three-month average unemployment rate rising 0.5% from its 12-month low) was triggered in July, and has never failed to coincide with a recession. At that point, the conversation quickly shifted to a slowdown in the labor market and the need for the Fed to react, quickly.

Since then, the unemployment rate has decreased by 10 bps to 4.2%, as the labor force stayed about the same size. We think continued enforcement at the border will keep migration subdued, and as a result will limit labor force growth. The downward pressure on the labor force should at the margin, tighten the labor market (more job opening relative to unemployed workers).

Even if the labor market tightens on the margin, our models suggest the Fed will still need to lower rates to support financial conditions. We still expect a 25-basis-point interest rate cut at the Fed’s meeting this month and more reductions into 2025. As such…

Cash yields are likely going to continue to fall.

We said coming into 2024 that cash rates would move lower. That’s happened—and we believe the trend will continue in 2025. The federal funds rate, which sets the rate banks can lend money to each other overnight (and is the biggest input for cash rates), stands at 4.75%, down 75 bps this year so far. The market is pricing another 85 bps of cuts next year.

一、劳动力市场预计更加稳健2024年下半年,劳动力市场备受关注。萨姆法则(Sahm Rule)在7月被触发,这一法则指的是三个月平均失业率上升0.5个百分点,且从未出现过与经济衰退不相关的情况。法则触发后,市场迅速聚焦于劳动力市场的放缓趋势,并讨论美联储需要快速采取行动以应对的必要性。

从那之后,失业率下降了10个基点至4.2%,而劳动力总量基本保持不变。我们认为,持续的边境管控将抑制移民规模,从而限制劳动力增长。劳动力供给减少,在边际层面会使劳动力市场更加紧俏(职位空缺与失业人数的比值将上升)。

即便劳动力市场边际上更趋紧俏,我们的模型仍显示美联储需要降息来维持宽松的金融环境。我们依然预计美联储将在本月会议上降息25个基点,且到2025年会有更多降息动作。

二、现金收益率可能会继续下行我们在2024年初就预测现金利率将会下滑。事实证明,这一趋势正在发生,我们相信这种趋势会持续到2025年。目前,联邦基金利率(决定银行间隔夜拆借成本的关键指标,也是现金收益率的主要决定因素)已降至4.75%,今年累计下降了75个基点。市场预计明年还将进一步降息85个基点。

图:2025年的现金利率很可能进一步降低

Many think of cash as a safe haven or even a source of income when interest rates are high. But, as rates continue to move lower, we believe cash is likely to underperform other assetes. Historically, in 10 of the last 12 cutting cycles, bonds have outperformed cash.

Cash is a necessary part of any lifestyle, but it’s not designed to beat inflation or produce long-term returns. What is? Equities. U.S. equities have historically returned 16% on average during soft-landing (our base case) cutting cycles.

Lower cash rates can present an opportunity for investors to consider moving out of excess cash and into assets that may have the potential for higher returns.

Equity earnings should broaden.

Equity returns have been dominated by the Magnificent 7 since the start of 2023. Over that time period, the S&P 500 has returned investors 62%, more than half of which was contributed by the Magnificent 7, which returned 242% over the same period.

The strong returns have come for good reason—the Magnificent 7 grew their earnings at 40%, while the remaining 493 stocks in the S&P 500 posted 2%. We think performance should broaden next year, as the “493” are expected to increase their earnings growth more than 5x (to 13%) in 2025.

在利率高企时,很多人会将现金视为避风港,甚至将其当作收益来源。然而,随着利率持续下行,我们认为现金相较于其他资产类别的表现将更逊色。历史数据显示,在过去12轮降息周期中,有10次债券的表现优于现金。

现金在日常生活中必不可少,但它并非为抗通胀或追求长期回报而生。那么哪些资产有望实现这些目标?答案是股票。历史上,在“软着陆”式降息周期(我们所假设的基准情景)中,美股平均回报率可达16%。

随着现金利率走低,对于投资者来说,这或许是一个从过剩现金转向具备更高潜在回报资产的良机。

三、股票的盈利增长将有望更加多元化自2023年初以来,美股回报主要由“七大科技龙头”(Magnificent 7)主导。同期标普500指数的整体回报率为62%,其中超过一半的收益来自这七家企业,而它们本身的涨幅高达242%。

之所以能出现如此强劲的涨幅并非偶然——这七家企业的盈利增速高达40%,而标普500中剩余的493家公司的盈利增幅仅为2%。我们认为明年的市场表现有望更加分散化,因为预计那“493家”企业在2025年将把盈利增速提升5倍以上,达到13%。

图:2025年的盈利增幅或将更加均衡

Lower interest rates, a renormalization of inventories and production, and easier comparables should act as tailwinds for the cohort in 2025.

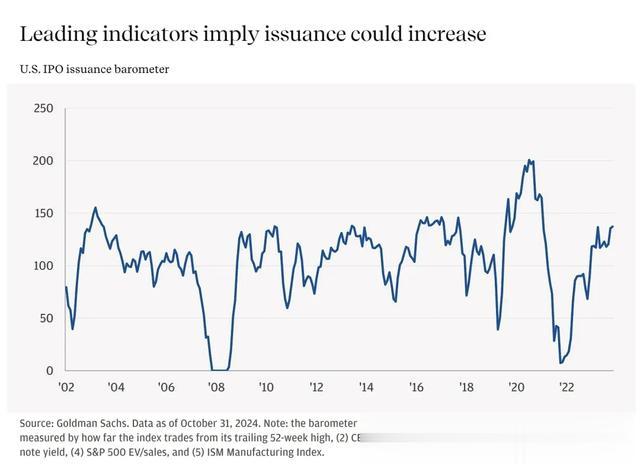

M&A activity is set to pick up.

With less than a month to go in the year, 2024 U.S. deal volume has already seen an uptick relative to last year (where activity was essentially frozen), and we think 2025 will be even more promising. The incoming administration and the markets’ expectations for a less onerous regulatory environment are helping to drive the recovery.

President-elect Trump has campaigned on deregulation. What does that mean? To start, he is likely to replace the leaders of multiple U.S. regulatory agencies, such as the FTC and the Justice Department’s antitrust division (where ~40% of the S&P 500 market cap is under investigation, and transactions of any size must be approved). Just last week, Trump announced Paul Atkins, who’s known for advocating for free-market policies, as Chair of the U.S. Securities and Exchange Commission (SEC).

The changes in these agencies and Washington are likely to usher in a period of deregulation, which could help to thaw frozen M&A, IPO and other financial market activity.

利率下行、库存与产能的重新平衡,以及更有利的基期效应都将成为2025年这批企业业绩增长的“顺风”。

四、并购活动预计回温距今年结束还有不到一个月时间,2024年的美国并购交易量已经较去年明显上升(当时的交易活动几乎陷入停滞)。我们预计2025年的前景会更为亮眼。新一届政府以及市场对更为宽松的监管环境的期待正在推动这一复苏。

当选总统特朗普在竞选中强调放松监管。这意味着什么?首先,他有可能会更换多家美国监管机构的负责人,比如联邦贸易委员会(FTC)和司法部反垄断部门(约40%的标普500市值企业都在其调查范围内,任何规模的交易都需其审批)。就在上周,特朗普宣布任命Paul Atkins出任美国证券交易委员会(SEC)主席,他是著名的自由市场政策倡导者。

上述机构与华盛顿方面的改组很可能预示一段“去监管化”阶段的到来,有助于解冻并购、首次公开募股(IPO)以及其他金融市场活动。

图:领先指标显示发行规模或将增长

As a backlog of deals stands ready to be cleared, increased private lending should help jump start transactions. The likely beneficiaries of a better environment for dealmakers? Wall Street banks, private equity and credit firms, and private business owners.

随着积压的并购案等待清理,私人信贷的扩张有望进一步推动成交量。受益于更友好的并购环境的群体包括:华尔街投行、私募股权与信贷机构以及私营企业主等。

AI infrastructure buildout should continue.

2024 is the year where many of us started to use AI tools in our day-to-day lives. We don’t see any sign of that reversing in 2025. On the contrary, as we mentioned in our 2025 Outlook: Building on Strength, we are likely to use these tools even more frequently across broader use cases, and that requires power. For example, a standard Google search requires about 0.3 watt-hours of electricity, while a single ChatGPT query uses about 10x as much.

For data centers alone, electricity demand is projected to nearly triple by 2030. The grid may need to add up to 18 gigawatts—about equivalent to three New York City’s worth of power demand.

五、AI基础设施建设将持续推进2024年是许多人日常生活中首次开始使用AI工具的一年。我们并未发现这种趋势在2025年会有所逆转。相反,正如我们在《2025年展望:蓄力前行》中提及的,我们可能会在更多场景中更频繁地使用AI,而这需要大量电力支撑。举例来说,一次普通的谷歌搜索消耗大约0.3瓦时的电量,而一次ChatGPT查询的耗能则可能是它的10倍。

仅在数据中心这一方面,到2030年的用电需求就预计会增加近三倍。电网系统或许需要增加约18吉瓦的供电能力——相当于三个纽约市的电力负荷。

图:数据中心或将引发电力需求激增

This means the infrastructure that supports these AI tools will need an upgrade. The Department of Energy estimates that 47,300 gigawatt-miles of additional transmission infrastructure will be needed by 2035.

The need to power AI, a technology with the potential to be more revolutionary than the internet, is real. We’re seeing increased investment from the hyperscalers through capex, and activity in private markets investing in energy providers. But we still believe the buildout for AI, including the energy needed to power the technology, is a long-term theme.

Investors can take solace from the past year. Equities hit record highs, inflation has settled, and a soft landing seems achievable. Looking ahead, equities continue to appear promising, deal making is expected to pick up, and long-term themes such as AI remain relevant.

这也意味着支撑AI工具的基础设施亟待升级。美国能源部估算,到2035年需要额外建设4.73万千瓦英里的输电网络。

AI可能比互联网更具颠覆性,对其进行能源供给并非纸上谈兵。我们看到超大型云计算企业(hyperscalers)正通过资本开支加码投资,私营市场也在投入到能源供应方。但我们依然认为,AI的全面部署(包括所需的能源基础)是一个长期话题。

投资者可以从过去一年中获得一些慰藉。股市屡创新高,通胀回落,经济软着陆的前景也愈发可期。展望未来,股市继续保持吸引力,并购交易有望回暖,AI等长期主题依旧值得关注。